Auto Mileage Deduction 2025

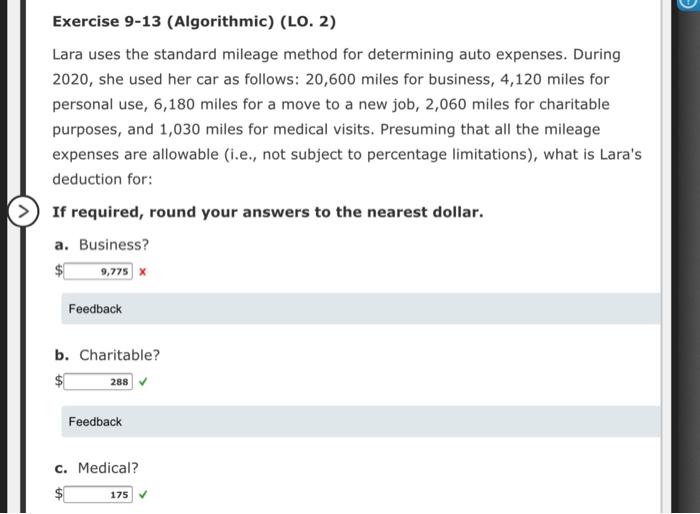

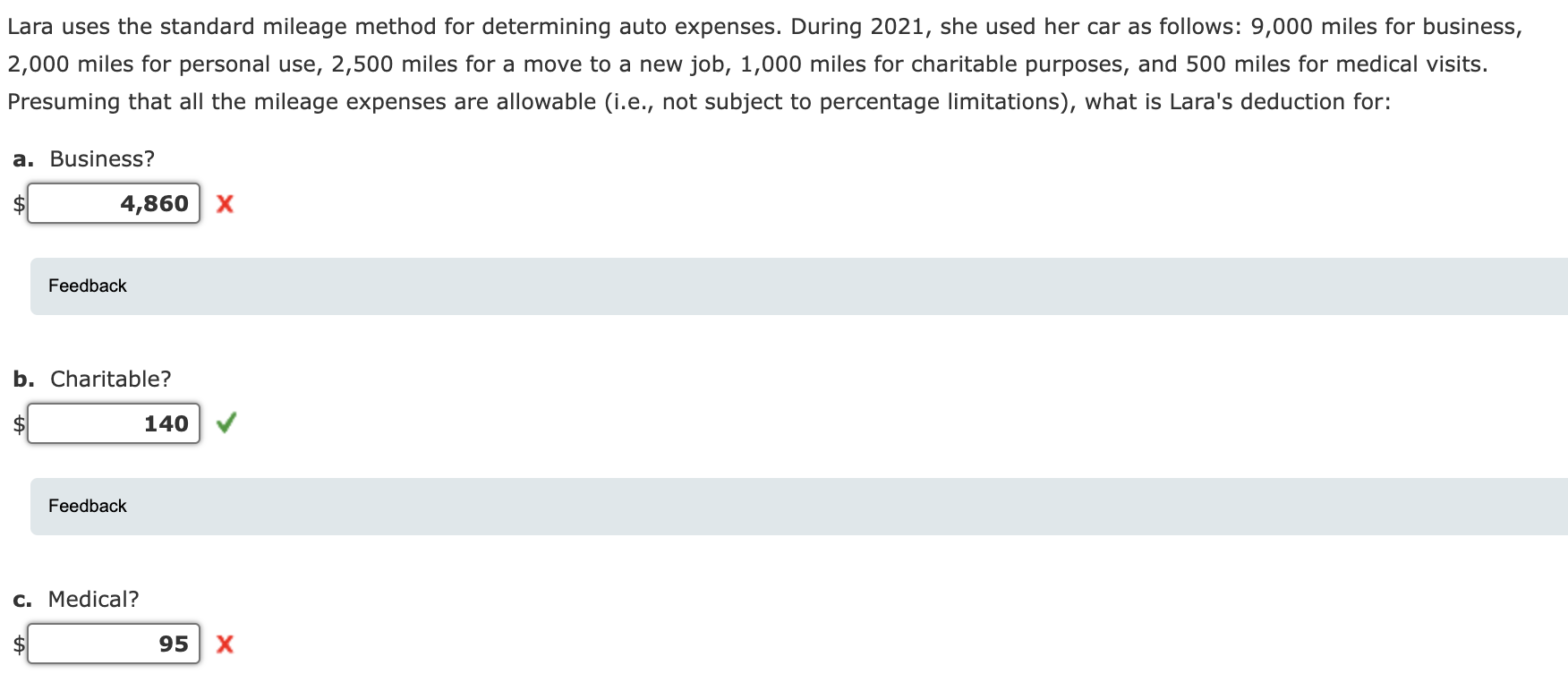

Auto Mileage Deduction 2025 - Standard Mileage Deduction vs. Actual Auto Expenses Gulla CPA, The mileage method is a fixed deduction amount (in cents) that you can take for every business mile you drive your vehicle for business. 67 cents per mile for business purposes; Solved Exercise 913 (Algorithmic) (LO. 2) Lara uses the, This takes into account most of the costs related to business use of the vehicle like fuel,. 17 rows page last reviewed or updated:

Standard Mileage Deduction vs. Actual Auto Expenses Gulla CPA, The mileage method is a fixed deduction amount (in cents) that you can take for every business mile you drive your vehicle for business. 67 cents per mile for business purposes;

Maximum Mileage Deduction 2025 Rene Wandis, The irs sets a standard mileage rate each year to simplify mileage reimbursement. For 2025, the irs' standard mileage rates are.

Auto Deduction Choices Actual Expense vs.Mileage Which is Right for, The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. 67 cents per mile driven for business use (up 1.5 cents.

How to Get 100 Auto Tax Deduction [Over 6000 lb GVWR] IRS Vehicle, The standard mileage rate for 2025 is $0.67/business mile. 64¢ per kilometre driven after that.

Solved Lara uses the standard mileage method for determining, This takes into account most of the costs related to business use of the vehicle like fuel,. 70¢ per kilometre for the first 5,000 kilometres driven.

Tax Tables For 2025 Married Jointly Darya Sindee, Washington — the internal revenue service. This takes into account most of the costs related to business use of the vehicle like fuel,.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical,.

Auto Mileage Deduction 2025. Washington — the internal revenue service. This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one.

IRS Finally Boosts Mileage Deduction for Rest of 2025 (Standard Mileage, For tax year 2023 (the taxes you file in 2025), the irs standard mileage rate is 65.5 cents per mile when used for business. Find standard mileage rates to.

Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates. 64¢ per kilometre driven after that.

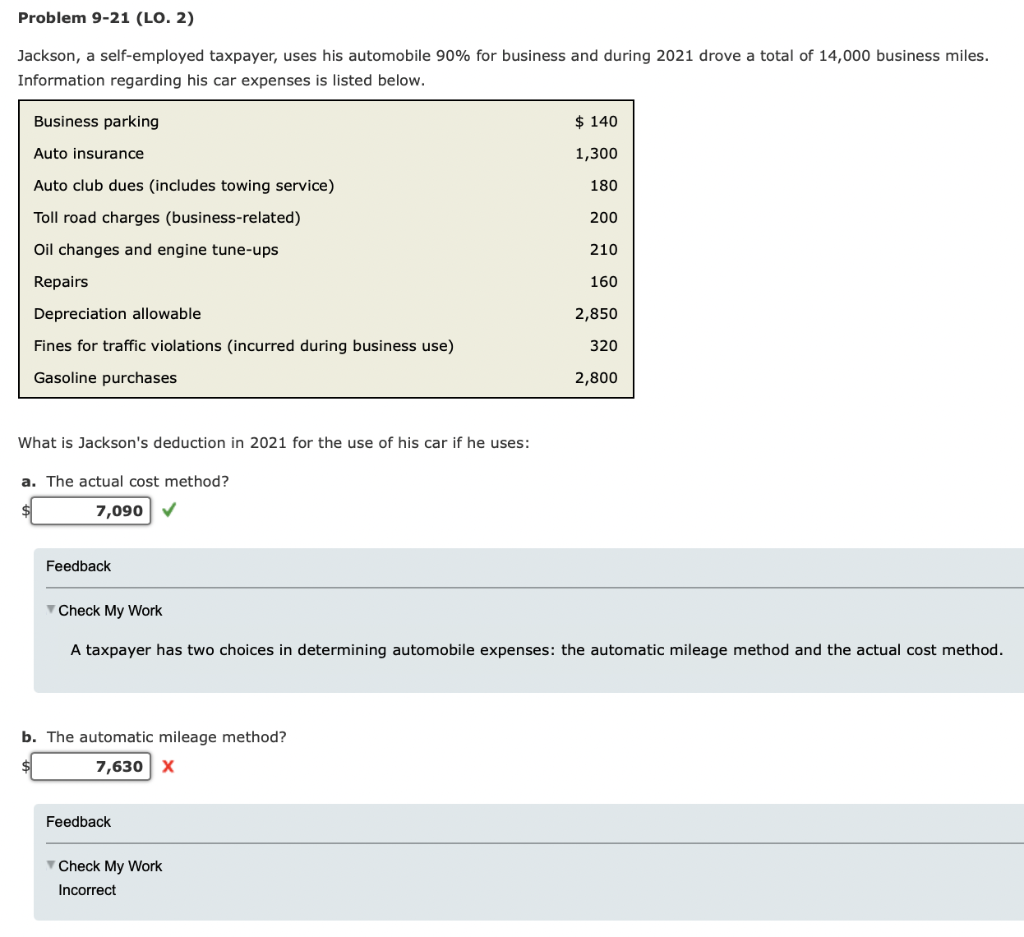

Solved Problem 921 (LO. 2) Jackson, a selfemployed, The irs increased the optional standard mileage rate used to calculate the deductible costs of operating a vehicle for business to 67 cents per mile driven, up 1.5. Find standard mileage rates to.

Mileage Tax Deduction Rules 2025, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023. That drops to 14 cents per mile when.